‘What we’re trying to do as value investors is exploit other people’s over reactions,’ says Temple Bar’s Ian Lance.

But the co-manager of the investment trust says that while that may sound easy it is difficult from a psychological point of view.

It means buying companies when there is a lot of bad news and when other people don’t like that company, he explains.

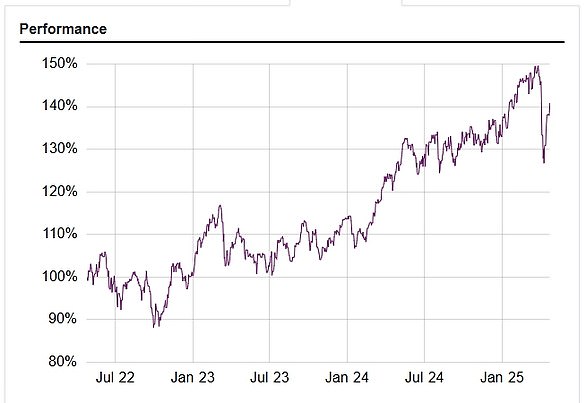

On this episode of the Investing Show, Ian Lance joins Simon Lambert to discuss Temple Bar’s approach to value investing and why the UK stock market has taken a turn for the better over the past year but bargain stocks still remain.

And those cheap shares are not just confined to under-the-radar companies, says Ian, instead there are a host of household name British businesses that are under-appreciated and offer plenty of opportunity to profit.

Among those big name firms that Temple Bar holds are banks NatWest and Barclays, energy giants BP and Shell, and broadcaster ITV.

Temple Bar is not confined to holding only UK companies but despite the stellar performance of star US firms over recent years, Ian explains why he would rather hold ITV in the portfolio than Netflix.

He also discusses why a combination of takeovers and share buybacks started to dial up investor sentiment for the UK and President Donald Trump’s policies and volatility should move cement the case for buying British stocks.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .