The price of gold has rocketed in recent months as investors seek a haven for their assets amid geopolitical and market uncertainty.

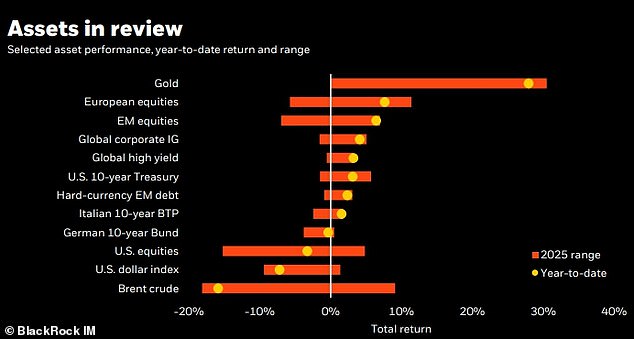

While equities have fallen back, with most indices making minimal gains year-to-date, investors have piled into gold.

The commodity has reached record highs in 2025, up nearly 25 per cent to $3,260 year-to-date.

The pace of growth has accelerated since President Trump announced tariffs, with gold up 9 per cent in the last month.

However, the reversal of some tariffs and the recently announced deal between the US and China could reverse gold’s fortunes.

Has the price of gold peaked, or will continued uncertainty push it higher? Experts below give their views.

Gold rush: Investors are retreating from equities and into gold this year

Why gold has reached its peak – according to some

On Monday, the price of gold fell 3 per cent following the US and China tariff deal.

David Belle, founder and trader at Fink Money told agency Newspage that it indicates that ‘we are the top for gold’.

As concerns over trade and tariffs dissipate, he says that ‘scared’ investors will pull back.

He adds that China has been a big buyer of gold since Trump’s election in November, ‘effectively hedging the past five months.’

As the issues turn a corner, China could start to buy USD-denominated bonds to earn yield from its USD holdings.

‘Gold doesn’t provide this yield. A trade deal being struck should send gold tumbling pretty hard.’

Harry Mills, director at Oku Markets says the recent gold rally was a ‘classic safe-haven demand play’ and given recent progress he ‘expects a natural pullback in the price.’

However, uncertainty remains, so he is not yet discounting a further bull run to $4,000.

Scott Gallacher, director at Rowley Turton warns investors to be cautious as Trump’s deal with China means ‘gold may start to lose its lustre.’

He adds: ‘Buying at a potential peak risks sharp losses if the fear premium unwinds.’

How gold could hit new highs

The record gold rally leads some experts to think that there is some way to go yet.

Anita Wright, chartered financial planner at Bolton James, thinks gold could reach as high as $4,000 if the economic and geopolitical issues persist.

If inflation continues to tick higher, gold could become an increasingly attractive asset to act as a hedge.

‘Gold, a tier-one asset needing no counterparty backing, is increasingly attractive,’ says Wright.

‘Central banks – not retail speculators – are leading gold purchases to de-risk reserves… Gold is rallying on structural shifts in global finance.

‘Corrections are likely, and volatility is inherent, but the underlying bid from institutional buyers remains solid.’

Demand from retail investors also continues and increasingly forms a bigger part of portfolios.

Faisal Sheikh, managing director at Monmouth Capital says as gains approach 100 per cent, ‘gold now presents a lot more of some portfolios than originally intended.’

He says while some investors might bank profits, ‘the idea that a handful of trade deals signal a return to normal is naive…

‘President Trump has already shown willingness to rip up not just deals signed in his first term, but even those struck in the chaotic past few months.’

Expectations central banks will accelerate the rate of cuts is also helping push the gold price higher, with markets predicting more to come.

Gabriel McKeown, head of macroeconomics at The Sad Rabbit Newsletter, says: ‘This, combined with a world rife with international turmoil and tariff proliferation, could be the spark that pushes gold prices towards the $4,000 threshold.’

If the price of gold does break the $4,000 barrier, investors are unlikely to be in for an easy ride, as ongoing uncertainty could lead to short-term drops in the price of gold.

McKeown adds: ‘Despite the enduring bullish outlook, the rapid climb in gold prices could lead to significant volatility.

‘With a series of unprecedented highs, the gold market risks overheating and may face bouts of profit-taking, so investors should brace for short-term fluctuations as gold reaches new heights.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .