Bosses of companies paid billions of pounds to arrange asylum seekers’ hotels are in line for bumper pay rises.

Their jackpots come as a report by Government spending watchdogs found asylum accommodation will cost taxpayers £15 billion over ten years, triple the first estimate.

Lucas Critchley, boss of Mears, one of three firms given the lucrative contracts, could receive a maximum 100 per cent pay rise this year. The new head of Serco, Anthony Kirby, could take home double what his predecessor received in 2024.

The third company, Clearsprings Ready Homes, is run by its majority owner, Essex businessman Graham King. It made a £91 million profit in 2023 and paid a £90 million dividend, according to its accounts.

The National Audit Office (NAO) last week revealed Government spending on accommodation for asylum seekers arriving on small boats had ballooned out of control.

The three firms were handed contracts to run asylum accommodation from 2019 to 2029. Clearsprings, covering Southern England and Wales, is set to receive £7.3 billion over the period, seven times the anticipated £1 billion when the contract was drawn up.

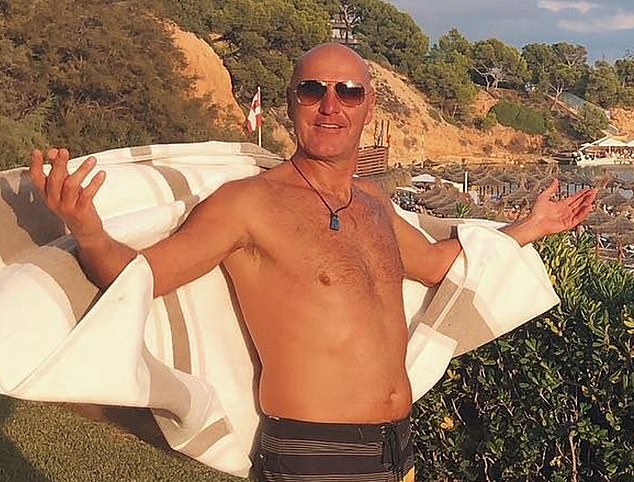

Lucrative: Clearsprings boss Graham King looks set to be Britain’s very first ‘immigration industry’ billionaire

Serco, covering the Midlands, East Anglia and the North-West, is in line for £5.5 billion, two and a half times a forecast £2.1 billion.

Mears is set to be paid £2.5 billion for arranging accommodation in Yorkshire, the North-East, Scotland and Northern Ireland. The predicted cost was £1.4 billion.

This could be a lucrative year for its boss, whose maximum pay is set at £1,336,000, including shares, long-term incentives and a bonus. Critchley, 43, answered the door at his large, Georgian home on a winding country lane in Essex, but did not comment.

Serco, which handles a swathe of public sector contracts, appointed Kirby, 44, in March. He is to receive a base salary of £845,000, but his total package for this year could reach £4.08 million including bonus, long-term incentives and pension. He has been contacted for comment.

The NAO said asylum accommodation in 2024-25 alone was £1.67 billion, with hotels accounting for 76 per cent of this. The auditors said asylum hotels ‘may be more profitable’ for the companies than other types of housing.

Clearsprings is by far the biggest earner of the three, receiving nearly half of the entire £15.3 billion projected cost from its contract for southern England.

Its boss, King, 57, started out running a caravan park on Canvey Island. He has a personal fortune of £750 million and is set to become the first ‘immigration industry’ billionaire. The tycoon, who split from his wife and was later with a glamorous Latvian businesswoman, Lolita Lace, 39, could not be reached for comment.

A neighbour of Clearsprings’ finance chief, Randle Slatter, told The Mail on Sunday about how he was invited to a party at the director’s house in Hornchurch, Essex, where ‘we were all saying what we did’.

Cashing in: Company bosses Anthony Kirby and Lucas Critchley

‘Randle said ‘you’re not going to like what I do’, and then he explained, and I didn’t,’ the neighbour said. ‘I don’t think we should be spending all that money on hotels. We should put them all on an island and process them there.’

Clearsprings’ accounts show its turnover rose to £1.74 billion in 2024 from £1.29 billion in 2023.

The Commons’ Home Affairs Select Committee is due to question directors from Clearsprings and Serco this week. Downing Street has concluded the policy of housing asylum seekers in hotels has fuelled the recent surge in support for Reform.

Mears said board pay reflected performance across the company’s activities, and that profit on the asylum seeker contract was at a ‘low margin’ of 6 per cent.

Serco said its chief executives have earned on average 53 per cent of the maximum available – and that asylum contracts make up ‘a small part’ of its £5.3 billion annual revenue. Clearsprings has been approached for comment.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .