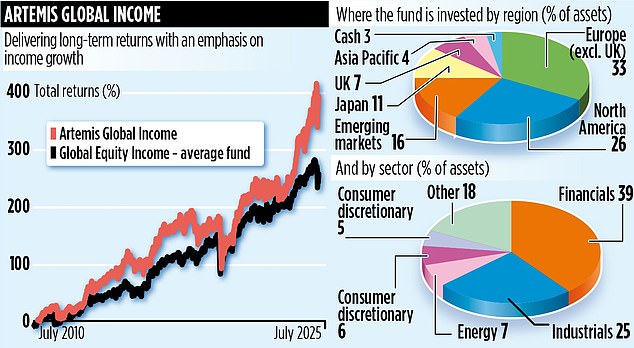

Investment fund Artemis Global Income will celebrate its 15th birthday in July – and investors who have been with it since the start are almost certain to have a lot to cheer about.

Although much can happen till then, the £1.6 billion fund is on course to deliver overall returns well in excess of 400 per cent.

Profits that launch investors have enjoyed already stand at 417 per cent – impressive when compared to the average for its global equity income peer group of 260 per cent. All this return has been achieved without exposure to the Big Tech US stocks other than a brief flirtation with Microsoft ten years ago.

The fund’s continued success is primarily down to the steadying influence of investment manager Jacob de Tusch-Lec, who has had his hand on the tiller from day one (it’s unusual for a manager to remain in situ for so long).

‘Artemis Global Income has changed less than the rest of the world over its 15 years,’ he says.

‘The focus from day one has been on finding cheap, attractively priced companies to deliver an income of between 3.5 and 4 per cent a year. We’re not for changing. It’s what the fund’s retail investors demand.’ He adds: ‘We don’t try to stretch this income, say, to 5 per cent. The aim is to grow the income we generate for investors over the long term.’

It’s an ambition that the fund has achieved, delivering average annual income growth since launch of 8 per cent.

The fund has 71 holdings with the portfolio slotting into three broad buckets. First there are what Tusch-Lec calls ‘bond proxies’ – established companies that provide a tidy income without necessarily generating stellar share price gains. Examples include UK supermarket giant Tesco and the US telecoms business Verizon.

The second bucket comprises companies likely to deliver future dividend growth – such as Brazilian aircraft manufacturer Embraer and Japanese engineering company Mitsubishi Heavy Industries.

The final bucket is full of ‘special situations’ – riskier investments offering attractive starting dividend yields as the businesses have hit difficult times, but Tusch-Lec thinks they will recover.

German Commerzbank, which Italian rival UniCredit has taken a big stake in, fits into this camp, with Tusch-Lec believing it will benefit from the German government’s massive fiscal stimulus aimed at boosting the economy.

Currently, the biggest slug of the fund (40 per cent) is in the dividend growth camp. ‘Dividend stocks have different characteristics,’ says Tusch-Lec, ‘and as an income investment manager you need to acknowledge that in the fund you construct.’

While Tusch-Lec says he is first and foremost a stock picker, the global economy still impacts the portfolio’s diversification. In broad terms, he says the US stock market remains too expensive.

‘The Magnificent Seven stocks are exceptional companies,’ he states. ‘But their shares are still too expensive.’

He believes other markets such as China and those across wider Asia offer better value – as do the UK and Europe. ‘Money will move out of the US market,’ he adds. ‘It won’t happen overnight but the genie is out of the bottle.’

As far as UK investors stand, he argues they should seek to rebalance their portfolios to ensure they are not too exposed to the US.

The Artemis Global Income fund has its biggest block of money in European stocks, including key stakes in defence companies such as Germany’s Rheinmetall, its largest holding.

Fund charges are reasonable at just under 0.9 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .