Property owners in Tennessee are questioning affordability now that home valuations are on the rise in Sullivan County.

Residents are wondering if their property value has doubled or tripled in price after finding out land would be reassessed.

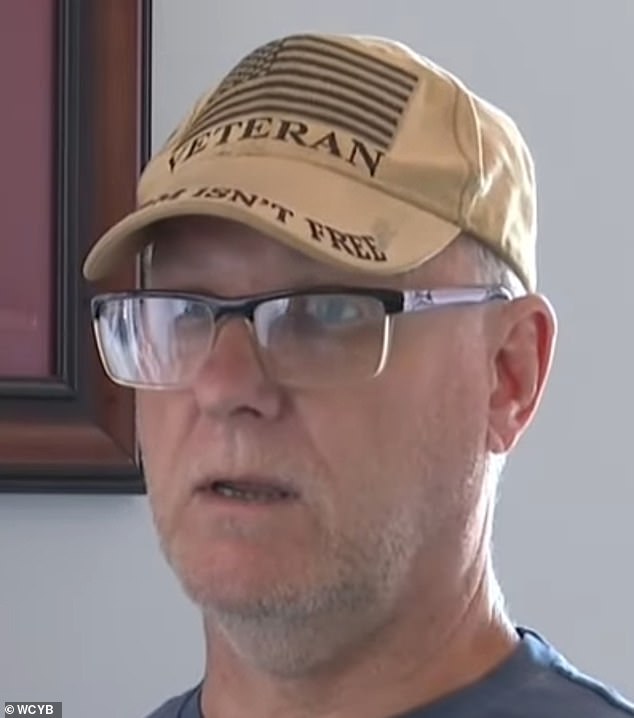

Sullivan County resident James Stewart is one of those worried homeowners, having discovered his property value has doubled.

‘I don’t know how I am going to pay for that,’ Stewart told News 5 WCYB.

‘It’s ridiculous and it’s not just me, it’s the whole county, it’s probably all the United States but right now I’m only worried about me in this county.’

The state is in the process of calculating new property values. These rates are based on market changes since the county’s last reappraisal back in 2021.

‘In the past, the market didn’t fluctuate as much as it did this time. So that’s why we’re seeing these big changes,’ Donna Whitaker, the county property assessor, told the outlet.

Now the county will wait to get a ‘certified tax rate’ from the state, which will likely be lower than the current rate.

Sullivan County resident James Stewart recently discovered his property value doubled

‘The value did go up on most everything in the county [but] the tax rate will go down,’ Whitaker added.

In the meantime, all residents can do is sit by and wait for the new rate number.

But locals like Stewart are still concerned about the future. If taxes do increase down the road, these new property values will haunt a lot of people, he told the outlet.

‘I think that everything should be relooked at on a scale that everyone can afford,’ Stewart stated.

‘If they think it’s worth this much and they’re going to charge us double, triple and 10 times what we’ve been paying for taxes, they need to figure out where we’re going to come up with this money.’

‘I think the value of everybody’s home has gone up around here because of the market,’ rather than their property increasing in size, a resident explained to WJHL.

‘My land has not gotten any bigger, nothing’s changed. But an $800 or $900 increase in property tax is ridiculous.’

Sullivan is not the only Tennessee county to receive a home value blow.

Property assessor Donna Whitaker revealed the current rates are based on changes made since Sullivan County’s 2021 reappraisal

The state expects Sullivan County’s new ‘certified rate’ to be lower than its current $2.4962 rate

Washington County residents were informed last year that the county’s new tax rate was $1.41 per $100 of assessed value – down from $2.15.

This number was decided based on the 54 percent increase in that county’s property values.

‘Our residential went up 68.48 percent, which we’ve never seen that before,’ property assessor Robbie McGuire told WJHL.

With the increases in over 68,000 properties, Washington County had a combined value of more than $3 billion, which was predicted to hike up to more than $4.5 billion.

Tennessee is predicted to experience a slight growth in home prices and values again this year.

Other counties expected to have souring property values include Davidson County and Hamilton County, which are homes to major cities like Nashville and Chattanooga.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .