Falling stock markets have spared few investors this month, even those in Jupiter Gold & Silver, a £600million fund which invests in a mix of mining companies and bullion funds whose performance is directly linked to the price of silver or gold.

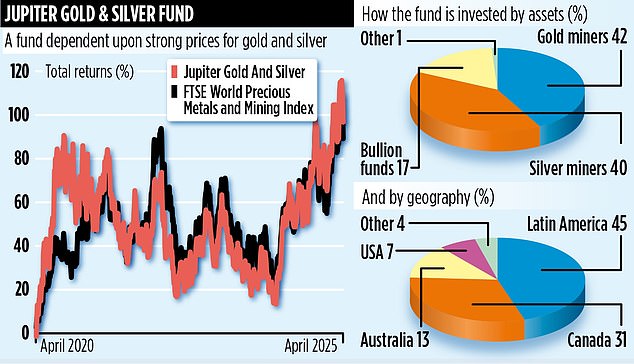

Although the Jupiter fund is not 100 per cent dependent upon world stock markets to generate gains for investors, its share price has fallen by some four per cent this month. To put this into perspective, it has still delivered a 35 per cent gain over the last year.

The fund is managed from London by Ned Naylor-Leyland, aided by Joe Lunn and Chris Mahoney. Naylor-Leyland has a track record of investing in precious metals going back 20 years and has been at the helm of Jupiter Gold & Silver since its launch in March 2016.

He describes the fund as covering an ‘important asset class’, especially given all the current uncertainties in the world.

The fund has two major components: first, direct exposure to gold and silver prices through funds that track their respective prices. The second part, which is racier in terms of risk and reward, comprises holdings in the shares of listed mining companies.

Currently, the portfolio is skewed towards gold and silver equities with respective holdings of 42 and 40 per cent. Bullion funds account for around 17 per cent.

When the managers are feeling bullish about the two metals, they hold more equities than bullion trusts. Despite stock market mayhem, they remain more bullish than defensive.

‘Mining stocks have been out of favour for quite a while,’ says Naylor-Leyland.

‘They have lurked in the corner, somewhat forgotten. But now there is a good chance that money will rotate into them. Investors will migrate money across.’

Naylor-Leyland eschews holdings in the mega mining companies in favour of mid cap businesses with production facilities located in the Americas (Latin America, the US and Canada) and Australia. He says these smaller companies tend to have stronger balance sheets and hold less debt than larger miners.

‘Companies located in the Americas and Australia tend to have good management teams and sound labour relations,’ he says.

Among its top 10 holdings is a stake in Canadian-listed mining company Discovery Silver.

‘We bought it in 2016,’ says Naylor-Leyland. ‘It owns Cordero in Mexico, the world’s largest undeveloped silver reserve.

‘It will come on stream in the next three years.’

He adds: ‘Silver is crucial to the development of the green economy, key in everything from electric cars to solar panels.

‘And there is currently a massive imbalance between supply and demand which should drive the silver price higher.’

Discovery Silver has also just bought a gold mining operation – the Porcupine Complex – from a mining rival in Ontario, Canada. The Jupiter fund owns more than 11 per cent of Discovery’s shares with the company forecast to account for some 3 per cent of the world’s silver supply in the near future. Naylor-Leyland says that if interest rates are cut in the United States to counter the threat of recession caused by tariffs, both gold and silver prices should rise. Although the prices of both metals have fluctuated wildly in recent days, they are ahead over the past year, gold significantly so.

The fund’s annual charges total a tad over 1 per cent.

Fund scrutineer FundCalibre gives Jupiter Gold & Silver an ‘elite’ label on the back of Naylor-Leyland’s pedigree and its value as a portfolio diversifier.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .