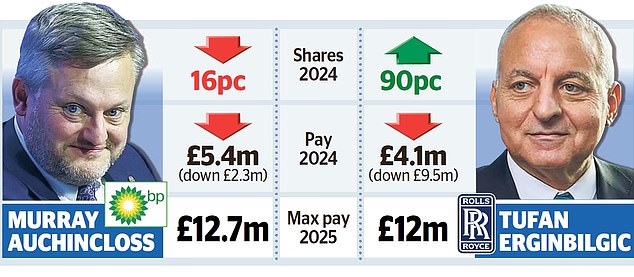

The bosses of two of Britain’s biggest companies saw their pay slashed last year – but could scoop millions more in 2025.

Rolls-Royce chief executive Tufan Erginbilgic took a near-£10million pay cut despite leading the engine-maker through a dramatic turnaround that has meant its share price has almost doubled.

And BP’s chief executive Murray Auchincloss received a £2.3million reduction – though this coincided with a slump in its shares and profits as the troubled oil giant continued to struggle.

Both were still paid handsomely, however, with Erginbilgic earning £4.1million and Auchincloss getting £5.4million.

And this year the Rolls-Royce boss is in line for a maximum of £12million while his BP counterpart’s deal is worth up to £12.7million.

Most of Erginbilgic’s cut reflected his inflated pay in 2023 when he was handed a £7.5million share package to compensate for leaving his previous job.

Pay cuts: Rolls-Royce chief exec Tufan Erginbligic (right) took a near-£10m pay cut last year while BP’s chief exec Murray Auchincloss (left) received a £2.3m reduction

He has led a remarkable recovery at Rolls-Royce since taking the reins at the start of 2023 – the share price was 93.2p and the company was worth £7.9billion.

The stock hit a record high above 800p this week and is now worth £68.11billion, making it the sixth biggest company on the London stock market.

Rolls-Royce last week upgraded its profits forecasts and pledged to hand £1.5billion to shareholders through a £504million dividend and £1billion stock buyback.

It was the first dividend for five years and first buyback for a decade and came as the company cashed in on a rebound in air travel following the Covid pandemic and increased defence spending.

Rolls-Royce said that it was on course to hit its 2027 profit targets, which were set in 2023, this year.

BP has not fared so well and Auchincloss is under pressure from shareholders, including activist Elliott, to turn the company around.

It made £7.2billion of profit last year, down about one-third compared to 2023, after oil and gas prices fell from the highs seen in the wake of Russia’s full-scale invasion of Ukraine in February 2022.

Outlining a ‘fundamental reset’ last week, Auchincloss admitted that the firm went ‘too far too fast’ on a ‘misplaced’ rush to net zero.

He announced plans to slash spending on renewable energy and instead invest more in oil and gas, which was a reversal of the strategy of his predecessor Bernard Looney.

But it is understood that Elliott believes he did not go far enough, with the future of Auchincloss and his chairman Helge Lund very much in doubt.

Auchincloss was appointed to the top job in January last year, having been acting chief executive since September 2023 after Looney was ousted.

BP is the eighth biggest company in the FTSE 100, worth £66.02billion.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .