Most mainstream global investment funds are chock-a-block with holdings in American technology companies such as Apple and Nvidia. But not Regnan Sustainable Water and Waste – a £235 million fund launched just over three and a half years ago.

Managers Bertrand Lecourt and Saurabh Sharma are mightily proud they don’t hold a single tech stock or, for that matter, a bank among its 45 holdings.

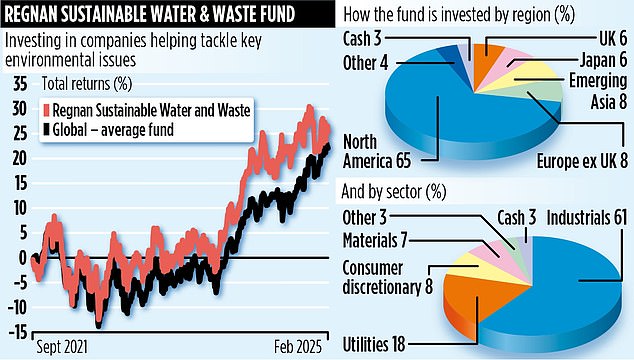

And the fund has performed rather well, delivering a total return of 25 per cent for investors in at the start – better than the 22 per cent gain registered by the average global fund.

‘We view the fund as a strong portfolio diversifier,’ says Lecourt, who has spent nearly a quarter of a century monitoring global water- and waste-related stocks.

‘There are no gadgets, and it is a great way for investors to hedge against rising water bills.’

He adds: ‘The fund has no tech, no financials, no energy stocks, and no banks. And no mega stocks.

‘In the investment area we mine, there is no equivalent Amazon of the water sector or Nvidia of the waste market. It means we often buy companies that are off the radar of everyone else.

‘This provides us with the opportunity to make money in areas of global stock markets that others eschew.’

As its name suggests, the fund’s objective is to hunt down companies focused on either water or waste – or both.

It’s a dual investment approach, but Lecourt says they are linked by a common driver: the increasing urbanisation of the world’s population.

He explains: ‘As more people live in cities, the demand for water and waste-related services increases. This creates the opportunity for a vast array of companies to rise to the challenge and provide support services and equipment.

‘It’s these companies that we are primarily interested in – businesses that are helping to establish the building blocks for economies across the world.’

British investors may be put off investing in water and waste by the current problems facing the UK water industry – Thames Water is on a financial precipice and most water companies are imposing steep price rises to pay for vital infrastructure.

But the fund is very much global in exposure.

More than 65 per cent of its assets are in US or Canadian companies, with UK exposure limited to holdings in FTSE100-listed United Utilities and Severn Trent.

As a matter of course, the fund does not invest in private companies such as Thames Water. ‘Ninety-five per cent of water and waste companies are in private hands,’ says Lecourt.

There are around 350 stocks that fit into the fund’s themes, but new companies (about ten a year) are being listed all the time. Of the 350-strong universe, Lecourt keeps close tabs on 150 and invests in a third of these.

Lecourt says most of the fund’s biggest holdings have been in the portfolio from the outset.

‘Our view is that if the investment case is not broken, we will continue to hold it,’ he adds. Among the top ten positions is a stake in French-listed Veolia – its dustcarts are a regular feature of our streets in the early morning.

‘Veolia is a nice blend of waste and water management services,’ says Lecourt.

Regnan is part of UK fund management group JO Hambro Capital Management, which in turn is owned by Australian financial giant Perpetual.

Total annual charges on Sustainable Water & Waste are reasonable at 0.94 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .